China holds a dominant position in the global furniture industry, serving as the leading producer and exporter. With an impressive output of nearly USD 160 billion, China commands a substantial 34% share in worldwide furniture production in 2023. This leading status extends to furniture exports, where China contributes over 30% of global exports. Such a prominent presence underscores China’s pivotal role in shaping the international furniture market, significantly contributing to production volumes and global trade.

Notably, China maintains

its leadership in specific furniture segments, holding the top position in

production and exports within the mattress, upholstered furniture and office

sector. This comprehensive overview emphasizes China’s multifaceted dominance

and profound impact across various dimensions of

the global furniture landscape.

The Chinese furniture industry exhibits a fragmented landscape, primarily dominated by small and medium-sized enterprises (SMEs). However, it is noteworthy that a select group of manufacturers has risen to prominence, boasting turnovers exceeding USD 1 billion. Oppein, Kuka, Man Wah, Suofeiya, and Yotrio are among these distinguished companies, each specializing in different sectors such as home and outdoor furniture. Delving into the top 100 companies identified by CSIL, the average turnover stands at USD 380 million, with an associated workforce averaging 3,402 employees.

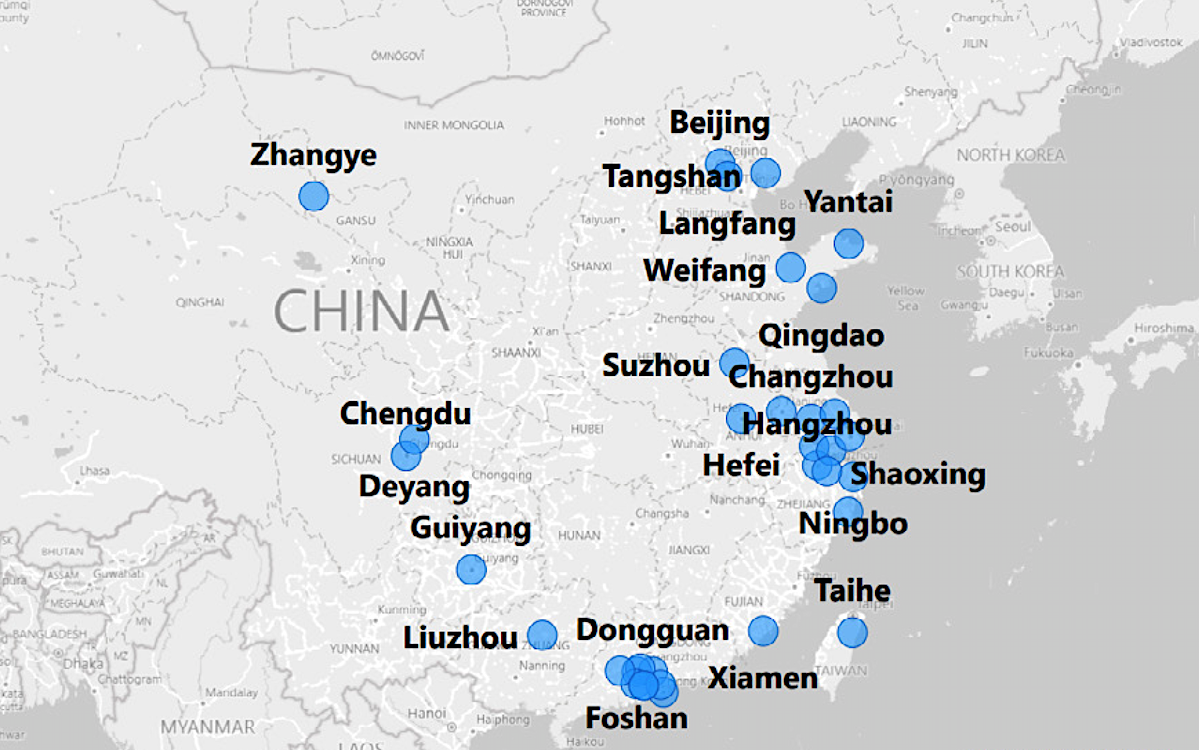

In the global top 200 companies, Chinese

entities make up 16%. The concentration of these leading manufacturers is

particularly located in the southeast coastal regions, with key cities

including Guangzhou, Shenzhen, Shanghai, and Foshan. Upon closer examination,

it becomes apparent that around 30% of companies in the industry specialize in

office furniture, including Dious, Henglin Chair, Jongtay, and UE Furniture.

Another 25% focus on upholstered furniture, represented by companies like

Markor, Trayton Group, Linsy, ZuoYou Furniture. Additionally, approximately 20%

concentrate on kitchen furniture. The remaining companies engage in various

sectors, such as general furniture production, customization, or outdoor

furniture. Furthermore, an additional dimension to the industry’s dynamics is

that nearly 25% of the top 100 manufacturers are publicly listed.

Courtesy of CSIL Centre for IndustrialStudies – Milan, Italy