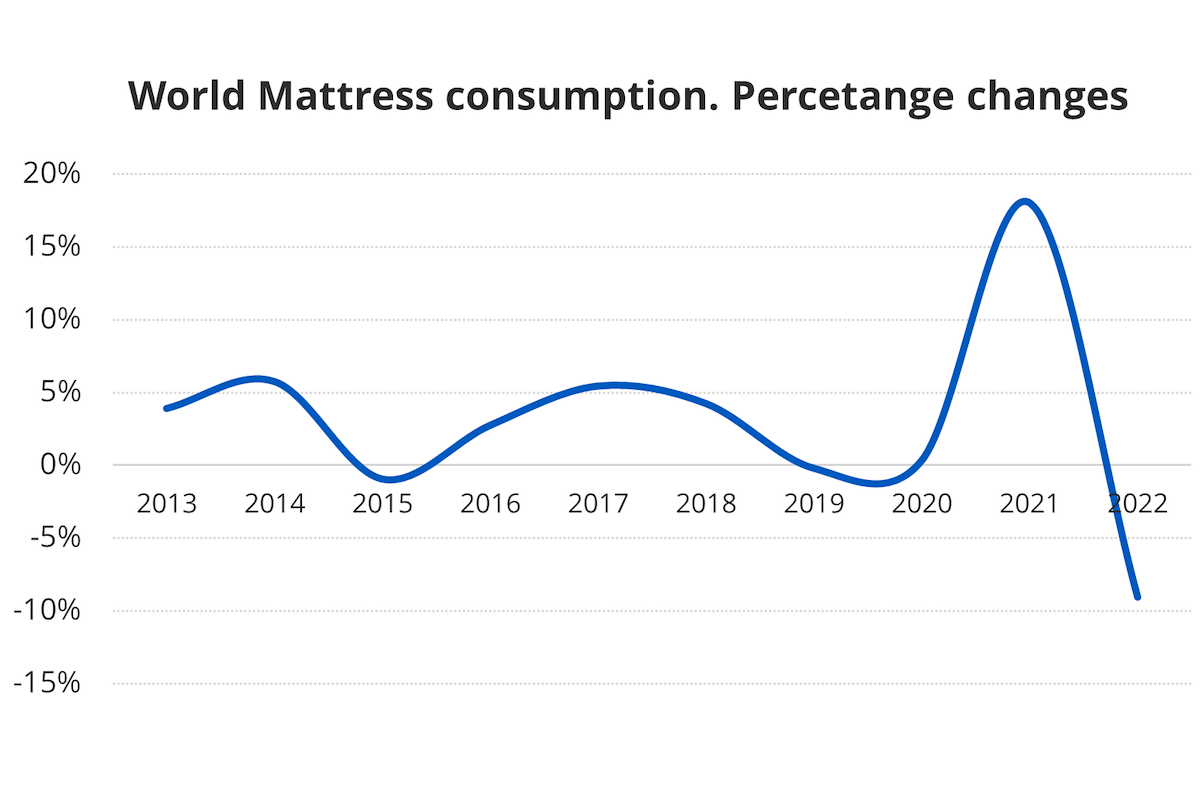

According to CSIL, the world mattress market is valued at US$ 30 billion

and has experienced stable growth over the past decade. In the short term, however,

the market can be described as a two-tier system, characterized by a gap

between demand and supply in 2021, followed by retailers’ overstock of

mattresses due to decreasing demand at the end of 2022 and early 2023 and by a

rebound in 2024.

During the pandemic, the mattress sector experienced remarkable growth within the furniture industry. With consumers forced to stay at home, there was a significant surge in demand for home renovations, leading to an early replacement of beds and mattresses. However, the industry also faced challenges related to disruptions in the supply chains, primarily due to the limited availability of raw materials and components for production.

In 2021, supply chain issues began to resolve, and world mattress production

increased consistently.

When pandemic restrictions eased in 2022, consumer spending started to shift away from home-related products. Additionally, high inflationary pressures have further undermined consumers’ purchasing power, and consequently demand for mattresses contracted. As a result, retailers reduced orders to manufacturers even below the pre-pandemic levels. Consequently, the world mattress industry contracted in 2022 over 2021.

In 2023, there was a contraction of the world mattress market in real terms resulting from the consequences of the turbulence in the financial sector and the persistence of inflation, which is rebounding in 2024 driven by positive trends indicating potential growth in the coming years, such as increasing consumer awareness of the health benefits of better sleep, surging demand for roll-packed/compressed mattresses in both online and traditional sales channels and the resume of the contract segment.

Courtesy of CSIL Centre for Industrial Studies – Milan, Italy